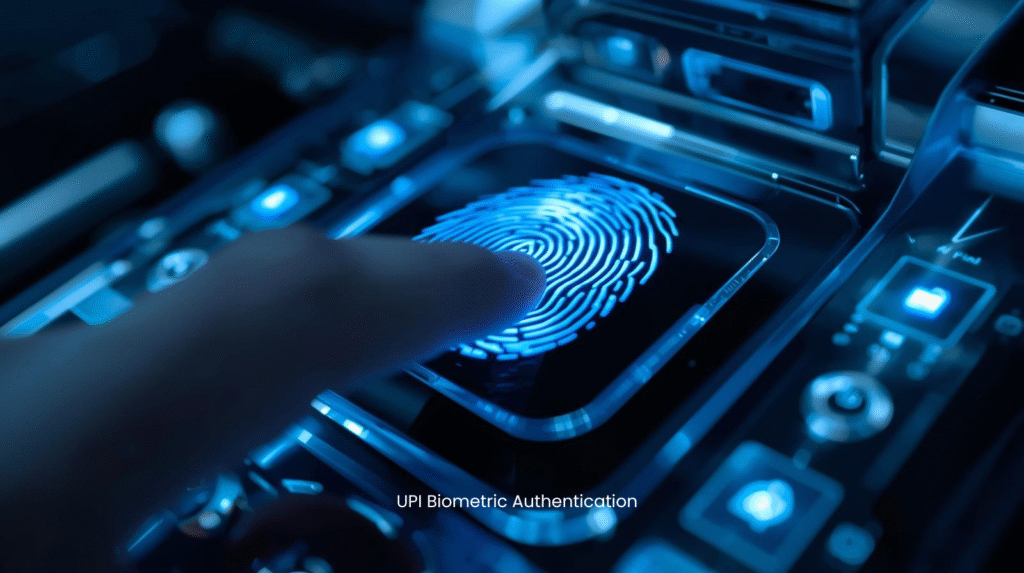

UPI Biometric Authentication is RBI’s latest step to secure digital payments with fingerprint and face ID verification for millions of users.

UPI Biometric Authentication is set to transform how millions of Indians make payments. The Reserve Bank of India (RBI) has announced that UPI transactions will soon accept fingerprint and face ID verification alongside PINs. This change marks a major leap in digital payment security, combining convenience with stronger safeguards against fraud.

What UPI Biometric Authentication Means for Users

Until now, UPI transactions required a 4–6 digit PIN. With UPI Biometric Authentication, users can:

- Approve payments using fingerprints or facial recognition already on their smartphones

- Skip remembering and typing PINs for every transaction

- Add an extra layer of identity-based security that is harder to bypass

For more than 500 million UPI users in India, this upgrade links payments to who you are, not just what you know, making fraud far more difficult.

Why UPI Biometric Authentication Matters

Most news reports highlight the update, but deeper questions deserve attention:

- Will biometrics replace PINs entirely, or remain optional?

- How will banks resolve disputes if fraud occurs despite biometric verification?

- Could India’s system inspire global adoption of biometric fintech security?

These answers will determine whether UPI Biometric Authentication becomes just another feature or a global model for digital finance.

Precautions Users Should Not Forget

Even with biometrics, users need to stay vigilant:

- Register biometrics only on personal devices

- Secure your SIM card to prevent hijacking attempts

- Review linked devices regularly in UPI apps

- Enable both SMS and email alerts to track suspicious activity

- Stay cautious of fraud calls, as banks never ask for biometric verification by phone

RBI Guidelines and Customer Protection

RBI’s framework on “Limiting Liability of Customers in Unauthorized Electronic Banking Transactions” still applies. Customers who report fraud within 3 working days and were not negligent are typically given zero liability, with provisional credit within 10 working days.

Official Circular: RBI Guidelines on Limiting Liability

With UPI Biometric Authentication, regulators and banks may need to issue clarifications about liability in cases of biometric spoofing or cloned fingerprints.

Why UPI Biometric Authentication Is Evergreen

This update is not temporary. UPI Biometric Authentication reshapes three core aspects of India’s financial system:

- Security – stronger protection against fraud

- Convenience – seamless, PIN-free transactions

- Trust – higher confidence in digital payments

The bigger question, “How safe is digital money?”, will always remain relevant. This update helps India move toward a stronger, long-term answer.

Key Takeaways

- RBI is introducing UPI Biometric Authentication for digital payments

- Fingerprint and face ID verification will work alongside existing PINs

- Security improves, but user vigilance remains essential

- RBI liability rules still protect consumers, but new questions may arise

- This is a milestone in India’s cashless journey and a global reference point

Explore More

- AI-Powered Threat Intelligence: The Ultimate Double-Edged Sword in Cybersecurity

- 5 Ways Zero Trust Stops Hackers Cold

- Cybersecurity’s Fastest War: The Ultimate Battle When AI Fights AI Beyond 2025

- The Ransomware Epidemic: Why SMEs Are The New Primary Target

- What Is Vibe Hacking and How Is AI Using It? 5 Shocking Facts About the Threat to Our Trust

- New Fraud Pattern Beyond 2025: No OTP, No Internet, Still Lost Money – Lessons from Shirdi incident

- Source: Reuters – India to roll out biometric authentication for digital payments

Disclaimer

This article is provided for informational and educational purposes only. It does not promote or encourage unlawful activity. The content is based on publicly available information and established cybersecurity practices, and every effort has been made to ensure accuracy.

Technical causes described are possible scenarios based on cybersecurity best practices and may not represent confirmed findings of any ongoing investigation. For any legal, financial, or technical decisions, readers are advised to consult their own qualified legal, financial, or professional advisors.