Struggling to stay on a budget without burnout? Learn 7 powerful, psychology-backed strategies to stick to a budget with freedom, joy, and long-term consistency.

Introduction

The first week of a new budget often feels like a clean slate.

You track every rupee.

You say no to impulse buys.

You feel… in control.

And then reality shows up.

A friend’s birthday. A sudden doctor visit. Late-night takeout after a tiring day.

Before you know it, your plan bends, snaps, and guilt creeps in.

Here’s a gentler truth: to stick to a budget doesn’t mean living under punishment — it means making a promise.

A promise that your money will serve your life, not the other way around.

This guide shows you exactly how to stick to a budget without feeling restricted.

It blends behavior science, simple systems, and compassionate design so your plan feels flexible, human, and sustainable.

We’ll reframe budgeting from “constant denial” to calm direction.

We’ll use identity, energy, and values — not just math — to make your plan stick.

“Freedom with structure beats restriction with guilt.”

Why Sticking to a Budget Feels So Hard (and It’s Not About Math)

Budgets don’t fail because you can’t add.

They fail because of human patterns:

- Default bias — We return to familiar habits even if they’re costly.

- Optimism bias — We predict lower expenses than we actually have.

- All-or-nothing thinking — One slip becomes “I blew it, I’ll try next month.”

- Restriction fatigue — Perpetual “no” erodes willpower.

- Aspirational budgeting — We plan for the person we want to be, not who we are today.

The fix isn’t more spreadsheets.

It’s creating an environment that helps you stick to a budget on good days and forgives you on tough ones.

Many plans collapse because they reflect who you wish to be next month, not who you are today.

Instead, start with a Reality Budget for two months, then shift gently. Kindness increases compliance — and makes it easier to stick to a budget for the long run.

What You’ll Get From This Guide

- What: A flexible system to follow any budget without feeling trapped.

- Why: Consistency beats intensity. A friendly plan lasts longer.

- How: 7 strategies that combine psychology + simple money mechanics.

You’ll also get a step-by-step playbook, visuals to stay motivated, a case study, myth-busting, and a future-ready outlook.

How to Stick to a Budget : 7 Proven Strategies

1) Redefine Budgeting as Permission, Not Prohibition

Most people think a budget says, “Don’t spend.”

A strong budget says, “Here’s what you may spend — guilt-free.”

It’s a permission slip.

Try this shift

- Rename categories with positive intent:

- “Freedom Fund” (discretionary joy)

- “Future Me” (investments, emergency fund)

- “Stability” (bills, essentials)

- Add a Joy Allowance (10–20% of income).

Spend it without justification. That’s the point.

Why it works:

Guilt drives rebellion. Permission builds trust. When spending is planned, it no longer feels like breaking rules.

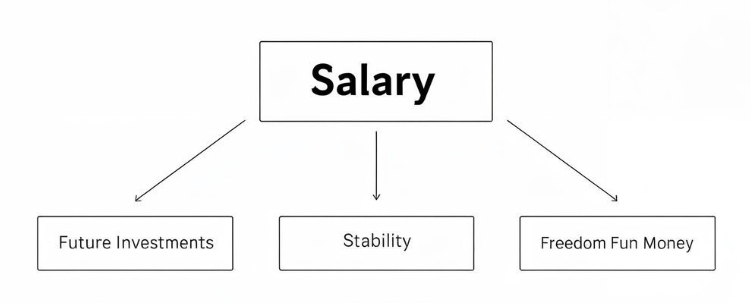

2) Automate First, Decide Later – The Anti-Willpower Engine

Willpower is a weak engine for long trips.

Automation is cruise control.

Set up three standing instructions on payday

- Future Me → Investments/SIPs/NPS/PPF

- Stability → Bills, EMIs, insurance

- Freedom → Discretionary account or wallet

Whatever remains is yours. No second-guessing.

Arjun set 30% to investments, 20% to fixed obligations, and moved 15% to a Freedom wallet. He never saw that money in his main account — willpower wasn’t needed.

Three years later, he had stability and weekends he enjoyed.

Pro tip: Use a different bank for long-term savings. Add a 24–48 hr withdrawal delay to disrupt impulse raids.

Two-Bank Rule: Keep long-term savings in a bank with a built-in 24–48 hour withdrawal delay. Add friction to protect the goals Future You depends on.

3) Budget by Energy and Timing: Spend Smarter, Feel Better

Traditional budgets answer what to spend.

Resilient budgets also answer when to spend and how you feel when you decide.

Timing design

- Map your bill calendar (many costs hit early in the month).

- Shift fun spends to later weeks to avoid early crunch.

- Create sinking funds for quarterly/annual items (insurance, travel, festivals).

Energy design

- Do “money sessions” when you feel calm and hopeful (post-workout, weekend morning).

- Avoid budgeting after a stressful day — your brain seeks relief, not restraint.

Why it works:

Most “fails” are timing and mood mismatches, not math errors.

4) Anti-Budgeting: Pay Yourself First, Then Spend, Rest and Relax

If categories overwhelm you, try the anti-budget.

- Save/invest a fixed % first (e.g., 30–40%).

- Pay key obligations automatically.

- Spend the rest freely.

This is ideal for busy people or those who hate tracking.

You still have structure — it’s just front-loaded.

Add a safety guard:

Cap daily UPI limits or move “Freedom” to a wallet card to avoid overflow spending.

5) Make Your Budget Bend: Easy Buffers and Fun Breaks

Rigid budgets snap. Flexible ones bend.

Three cushions that preserve sanity

- Flex Buffer (10–15%) — A small monthly cloud for the unpredictable.

- Cheat Window — One planned splurge day/weekend per month.

- Micro-Wins — ₹100–₹300 mini-budgets for joy, gifts, or learning.

Why it works:

When you add cushions, you’re not “breaking the rules” — you’re making it easier to Stick to a Budget without feeling trapped. Planned deviation prevents blowouts, and micro-wins build a self-image of someone who can have fun and still keep promises.

6) Budget Your Environment – Not Just Your Money

You don’t rise to the level of your goals.

You fall to the level of your environment.

Remove frictionless spending

- Uninstall shopping apps until weekends.

- Turn off “deal” notifications.

- Hide saved cards on browsers.

Add friction to leaks

- Separate bank for long-term savings.

- Require a one-tap “cool-off” rule for purchases above ₹1,000.

- Put a visual tracker on the fridge/phone lockscreen.

Why it works:

If you want to truly Stick to a Budget, design an environment that reduces temptation and supports better habits. Environment beats willpower, every time.

7) Spend According to Who You Are

Numbers don’t stay in mind unless the story does.

Think of your money as three people sitting with you at the dining table:

- Past Me → paying loans, clearing dues, finishing old responsibilities.

- Present Me → enjoying life today, health, family time, small joys.

- Future Me → saving, investing, building safety and freedom.

Take Riya’s story.

At first, she gave everything to Past Me — clearing her student loan. It was responsible, but she felt stuck.

Later, she listened only to Present Me — dinners, shopping, travel. It was fun, but her savings disappeared.

Then she focused only on Future Me — investing, cutting down all pleasures. Very soon, burnout followed.

Finally, she understood: all three need attention.

Now once a month she does a Three-Selves Check-In. She marks each expense as Past, Present, or Future. If one is starving, she adjusts.

The aim is not perfection, but balance.

When the three selves are in harmony, money flows smoother, and life feels lighter.

Because a budget is not only about money—it is about keeping peace between who you were, who you are, and who you are yet to become.

The Two Bank Accounts

Aarav felt broke before month-end every time.

One evening, his grandfather said, “You have two bank accounts — one at the bank, one in your mind. If the mind’s account is full of fear and shame, the real account will always feel empty.”

Aarav stopped treating budgeting as punishment and started treating it as self-respect.

His ritual changed: soft music, clear light, one cup of chai.

In three months, the numbers didn’t just improve — his relationship with money softened.

To truly stick to a budget, you must first heal the mind’s account. When your thoughts are calm, your actions follow — and the bank account naturally reflects that inner balance.

Budget Myths That Keep You Stuck

- “Budgets are for low incomes.”

Planning is for anyone who wants options. The wealthy call it “asset allocation.” - “Fun ruins budgets.”

The right amount of fun sustains budgets. - “If I slip, I failed.”

You collected data. Adjust and continue. - “Apps will fix it.”

Tools help. Environment + identity keep it.

Framework: The Freedom-First Model (FFM) – A Simple Model That Works

A simple, values-aligned structure you can apply to any income level.

- Foundation (50%) — Housing, utilities, groceries, transit, essential phone/data.

- Future (25–30%) — Investments/SIPs, emergency fund, insurance, debt payoff.

- Freedom (15–20%) — Joy allowance, dining, hobbies, mini-gifts.

- Flex (5–10%) — Buffer for the unpredictable.

Adjust by season (festivals, exams, travel).

Your life changes; your model should too.

Your 7-Day Kickstart Plan to Stick to a Budget

Day 1 — Reality Check

Look back at the last 2–3 months of expenses. Write down what you spent, when, and why. Notice the emotions behind each spend — excitement, boredom, stress. Awareness is step one to help you Stick to a Budget.

Day 2 — Fix the Timing

List every bill and its due date. If you can, shift a few dates or keep a small buffer in your account. This way, bills don’t crash into each other all at once.

Day 3 — Automate the Big Three

Set automatic transfers for:

- Future → savings/investments

- Stability → rent, bills, basics

- Freedom → small joys, travel, experiences

Automation makes it easier to Stick to a Budget without relying only on willpower.

Day 4 — Choose Your Style

Pick one method — classic budget categories or the simple Anti-Budget (save first, spend the rest). Don’t mix. Stick with it for 60 days before you adjust. Consistency is how you learn to truly Stick to a Budget.

Day 5 — Shape Your Environment

Make spending harder, not saving.

- Turn off shopping notifications.

- Keep a separate bank for savings.

- Add a “cool-off” step for purchases over ₹1,000.

- Move shopping apps into a hidden folder named Decide Tomorrow. That tiny pause can save you thousands over time and helps you Stick to a Budget without feeling deprived.

Day 6 — Make It Visual

Print a simple tracker, add a spending bar to your phone lockscreen, or keep a jar for “money wins.” Visual cues keep your motivation alive and remind you why you want to Stick to a Budget.

Day 7 — Ritual & Review

Pick one calm time each week — 20 minutes with tea or coffee. No shame, just data. Ask: What worked? What didn’t?

Before you start, breathe slowly for a minute. A calm body makes kinder, smarter money choices — and ensures you can Stick to a Budget for the long run.

Kavya’s Freedom Budget

Profile: 28, ₹60K/month, five failed budgets.

Pain: Always felt “punished”; binged in month-end loneliness.

Shift: Adopted FFM + Micro-Wins + planned cheat weekends.

Structure she used

- Foundation: ₹30K

- Future: ₹18K (SIPs + PF + insurance + small debt snowball)

- Freedom: ₹9K

- Flex: ₹3K

Tiny changes that mattered

- UPI cool-off > ₹1,000.

- Friday “solo date” from the Freedom pot.

- A ₹200/month “random kindness” envelope.

Result (18 months): ₹4.2 lakh saved, debt gone, anxiety down.

“My budget stopped arguing with my life.”

Boundary Rule: Kavya set a “24-hour yes” rule for non-essential buys. If she still wanted it the next day, she purchased — half the time, she didn’t.

Breaking the Shame Cycle: How to Gently Reset Spending Habits

Shame Loop: Overspend → guilt → clamp down → feel trapped → overspend.

Break it with compassion budgets, cheat windows, and micro-wins.

Set-Point Theory: Your brain has a natural spend level shaped by habit and context.

Big cuts feel like starvation.

Lower gradually (₹2–5K step-downs), and celebrate each threshold.

Why Flexible Budgets Win Over Rigid Ones

| Aspect | Rigid Budget | Flexible Budget |

|---|---|---|

| Fun | Often zero | Scheduled & guilt-free |

| Adjustments | Rare, seen as failure | Monthly, seen as maturity |

| Triggers | Ignored | Tracked & planned |

| Environment | Unchanged | Designed deliberately |

| Results | Burnout, yo-yo | Calm consistency |

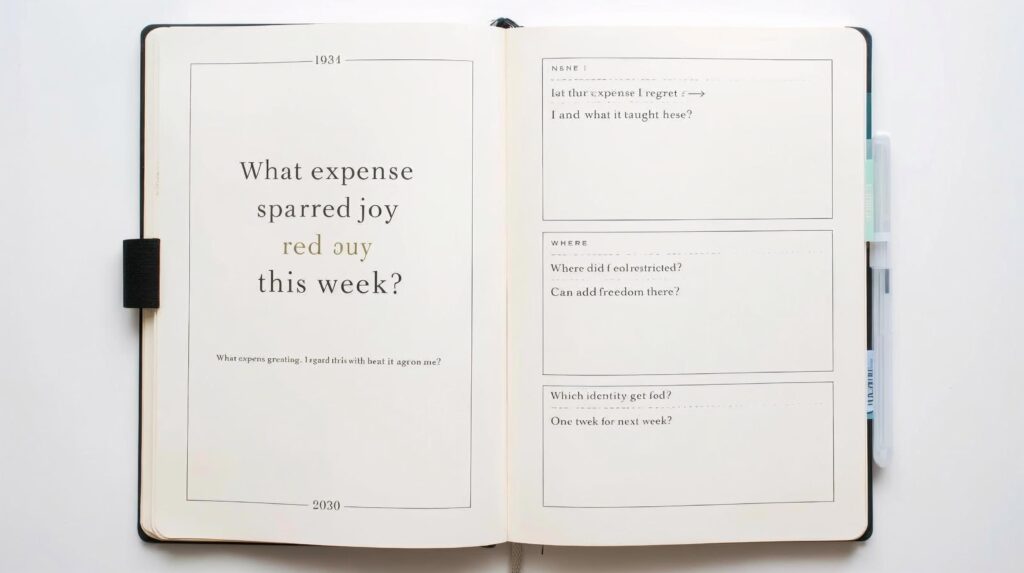

Sunday Money Soul-Scan

Reflect. Realign. Restart.

- What expense sparked joy this week?

- What expense I regret — and what it taught me?

- Where did I feel restricted? Can I add freedom there?

- Which identity got fed: Past, Present, or Future Me?

- One tweak for next week?

The Future of Budgeting Will Feel Different

The next evolution of budgeting won’t be louder apps.

It will be quieter systems that understand your cycles, nudge without nagging, adapt to festivals or exams, and visualize trade-offs in real time.

Budgets will integrate health, habits, and carbon footprint alongside money.

You’ll see how a habit shift affects both your wallet and your well-being.

The future of learning how to stick to a budget won’t bully you into control.

It will coach you into calm — where money management feels like guidance, not punishment.

Key Nuggets

- Permission, not prohibition — budgets are freedom maps.

- Automate first — willpower is too fragile for monthly marathons.

- Timing + energy matter as much as categories.

- Anti-budget works if you hate tracking.

- Flex saves consistency — buffer, cheat windows, micro-wins.

- Environment design beats good intentions.

- Identity alignment is the deep glue.

Draw the Line for Freedom

What is one place your budget feels like a cage?

Add a Freedom Rule for that place this month (e.g., “Two café visits weekly — prepaid.”). Put it in your plan on purpose.

Budgeting with Breath

A budget is not a fence — it’s a path.

Walk it with kindness.

Let it bend with your seasons.

Feed your Present, honor your Past, and protect your Future.

And when the month ends, don’t ask, “Did I follow it perfectly?”

Ask instead, “Did my choice to Stick to a Budget help me live more by design than by default?”

If the answer is even partly yes, you’re already winning.

Explore More

- Ultimate Budgeting Guide 2025: 5 Frameworks That Work in Real Life

- How to Save Money Fast on Low Salary: 30-Day Sprint

- Financial Independence Mistakes: 8 Mistakes Holding You Back From True Freedom

- How to Budget Money in 5 Steps

- Why Financial Independence Beats Riches in the Long Run : Think Beyond 2025

- The Psychology of Money: 18 Hidden Secrets of Financial Success

- The Hidden Power of Compounding: 7 Lessons for Life

- Emergency Expense Preparedness

FAQ

1) I always fall off mid-month. What’s the first fix?

Shift big joy spends later in the month, add a 10–15% flex buffer, and start a mini float so early bills don’t crush you.

2) Is it okay if I don’t track every expense?

Yes. If you front-load savings and obligations, the rest can be free-spend. Choose anti-budgeting if details drain you.

3) How much “fun money” is healthy?

Typically 10–20%. If you’re paying off high-interest debt, start lower but keep some joy to prevent burnout.

4) What if my income is irregular?

Base your budget on your minimum reliable income. Treat extra income as a structured bonus split (e.g., 50% Future, 30% Flex, 20% Freedom).

5) How do I stop impulse buys?

Design friction: remove apps, enable cool-off rules, separate banks, and lower UPI limits. Environment first.

6) What if my partner and I fight over money?

Do a monthly Money Date. Agree on joint goals + separate Freedom money for each person. No surprise purchases above a set threshold.

7) Are cheat days “bad” for budgeting?

The opposite. They’re pressure valves. Planned indulgence prevents unplanned blowouts.

8) How big should my emergency fund be?

Aim for 3–6 months of essentials. If that feels huge, build a 1-month starter fund fast, then layer up.

9) I feel ashamed of past mistakes. How do I start?

Begin with compassion. Label a small “Compassion Category” and practice budget forgiveness. You’re building new identity, not replaying old stories.

10) Can budgeting become enjoyable?

Yes — when your plan funds your values and your environment helps you succeed. Make the ritual calm and kind. The numbers will follow.