Green Energy Stocks : Discover powerful global insights into green stocks beyond 2025. Explore renewable energy trends, risks, case studies & a step-by-step portfolio guide.

Green Energy Stocks Beyond 2025: Powerful Insights, Trends, Risks & Portfolio Guide (Global View)

Introduction

In 2025, the financial world is experiencing the largest capital reallocation in history — from fossil fuels to green energy and climate-focused stocks.

- Globally, $1.5 trillion annually is now flowing into renewables, EVs, storage, and green hydrogen.

- In India, the government has pledged 500 GW of renewable capacity by 2030, making it a hotbed of clean-tech investment.

But the big question for investors is:

Are Green Energy Stocks a true wealth-creation opportunity beyond 2025, or just a short-term bubble inflated by policy hype?

This article dives deep into the what, why, and how of green investing, blending global + Indian perspectives with:

- Key trends shaping climate investments.

- Case studies of winners (and lessons from strugglers).

- A myth-busting view of common misconceptions.

- Behavioral insights into investor psychology.

- A step-by-step portfolio framework for beginners.

- A 2035 outlook for where green stocks might be headed.

“Sustainable wealth creation is now driven by Green Energy Stocks?”

Why Green Energy & Climate Stocks Matter Now

Green Energy Stocks are companies focused on renewable energy, climate tech, or sustainability solutions.

Climate urgency + policy support + tech breakthroughs make them central to the global economy.

Investors gain exposure via individual stocks, ETFs, or funds tied to solar, wind, hydrogen, storage, and climate tech.

Back in 2012, many laughed at the idea of Tesla becoming a trillion-dollar company. Investors saw EVs as “luxury toys.” By 2021, Tesla created more wealth than some oil majors combined. Today, Indian parallels exist with Adani Green or Suzlon Energy — companies once doubted, now transforming portfolios.

Takeaway: Green investing is no longer about “ethics” — it’s about mainstream financial performance.

Global Trends Driving Green Energy Stocks Investments Beyond 2025

- Net-Zero Commitments: ~140 countries pledging carbon neutrality by 2050.

- Carbon Pricing Expansion: EU, Canada, Singapore lead carbon taxes/trading.

- Energy Security: Geopolitical shocks pushing renewables (e.g., Europe after Ukraine war).

- Tech Leapfrogging: Hydrogen, storage, AI-led grids maturing fast.

- Just Transition: Ensuring equitable adoption in developing economies.

Myth: “Green stocks are only profitable in the West.”

Reality: India, China, and Brazil are becoming the largest markets due to population + energy demand.

Sectors to Watch in Renewable Green Energy Stocks

Solar Power

- Global solar costs fell 90% in a decade.

- India’s rooftop & rural solar projects transforming villages.

Wind Energy

- Europe leads offshore wind.

- India scaling hybrid (wind + solar) parks.

Energy Storage

- CATL, Tesla, Northvolt scaling lithium-ion.

- India’s 50 GW storage target by 2030.

Green Hydrogen

- Australia, EU leading pilot projects.

- India invests ₹19,744 Cr in National Hydrogen Mission.

Smart Grids & Electrification

- Nexans (France), Siemens (Germany) driving grid modernization.

- Tata Power-DDL India experimenting with AI-powered demand forecasting.

“Without storage and smart grids, renewables are like cars without roads.

Stock Categories

Core Renewable Providers

- NextEra (US) – Renewable utility giant.

- Orsted (Denmark) – Offshore wind pioneer.

- Brookfield Renewable (Canada) – Hydro + solar global exposure.

- Adani Green (India) – World’s 2nd largest solar player.

Innovators & Tech

- Plug Power (US) – Hydrogen fuel cells.

- Bloom Energy (US) – Solid oxide cells.

- Reliance Green (India) – Betting on green hydrogen.

Storage & Batteries

- CATL (China) – Global EV battery leader.

- Northvolt (Sweden) – Europe’s supply chain anchor.

- Exide / Amara Raja (India) – Moving from lead-acid to EV storage.

Climate Tech / Carbon Capture

- Climeworks (Switzerland) – Direct Air Capture.

- Carbon Clean (UK/India) – Industrial carbon capture.

- IPO watchlist: Indian EV startups planning listings 2026+.

Suzlon Energy (India)

Once bankrupt, Suzlon restructured debt, cut costs, and secured new projects — turning into a leaner wind energy giant in 2024.

Lesson: Even fallen green companies can reinvent.

Top Green Energy Stocks to Watch (Not Recommendation)

NextEra Energy (US)

- Largest renewable utility worldwide with ~70 GW capacity.

- Consistent 10% dividend CAGR backed by regulated utility income.

- Expanding aggressively into solar and wind across North America.

- Insight: Rare blend of stability + aggressive clean growth.

Orsted (Denmark)

- Offshore wind pioneer with 12 GW operational and 50 GW in pipeline.

- Fully transitioned from oil & gas to 100% renewables in under 15 years.

- Strong EU policy support underpins expansion.

- Insight: A reinvention success story for legacy energy players.

Brookfield Renewable (Canada)

- Diversified portfolio: hydro, wind, solar with ~25 GW capacity.

- Dividend yield ~4% secured through long-term power purchase agreements (PPAs).

- Present across North America, South America, Europe, and Asia.

- Insight: Ideal for investors seeking steady income + clean exposure.

CATL (China)

- World’s #1 EV battery supplier with ~37% global share.

- Supplies Tesla, BMW, and major Chinese EV manufacturers.

- Investing in solid-state battery R&D for next-gen energy storage.

- Insight: The ultimate “picks-and-shovels” play on the EV boom.

Adani Green (India)

- World’s 2nd largest solar developer with ~18 GW pipeline.

- Backed by international green bonds and global partnerships.

- Rapidly expanding hybrid renewable parks in Rajasthan and Gujarat.

- Insight: Symbolizes India’s rapid scaling in solar capacity.

Suzlon Energy (India)

- Wind energy pioneer with presence across 17+ countries.

- Completed debt restructuring, returned to profitability in FY24.

- Securing new wind projects with stronger balance sheet.

- Insight: A turnaround stock proving resilience in green energy.

Waaree Renewables (India)

- India’s leading solar EPC provider with 2 GW+ secured projects.

- Strong presence in rooftop and decentralized solar solutions.

- Expanding in residential and commercial solar adoption.

- Insight: Positioned to ride India’s distributed solar boom.

KPI Green (India)

- Focused on hybrid solar-wind projects, growing ~60% YoY.

- Serves industrial and commercial clients with clean power.

- Developing long-term PPAs to ensure stable revenue streams.

- Insight: India’s hybrid model champion, balancing intermittency.

SJVN (India)

- Public Sector Undertaking (PSU) with a 25 GW clean capacity target by 2030.

- Diversified across hydro, wind, and solar energy.

- Strategic government backing ensures long-term stability.

- Insight: A government-backed stability play with growth upside.

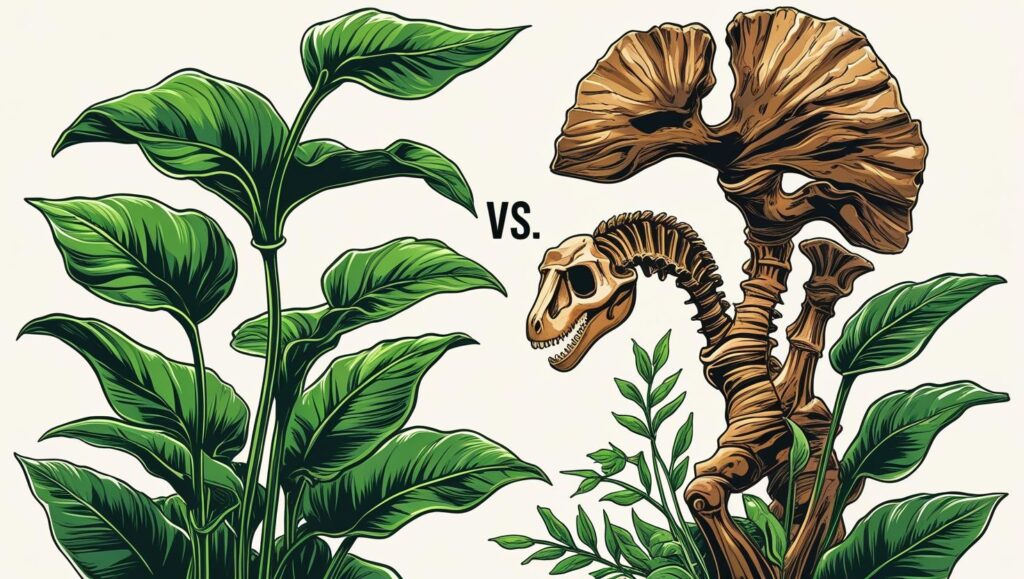

Comparison: Green vs Fossil Stocks

| Criteria | Fossil Stocks (Oil & Gas) | Green Stocks (Renewables) |

|---|---|---|

| Volatility | High (linked to oil price) | Moderate (policy-driven) |

| Dividend Stability | Strong legacy dividends | Growing but variable |

| Growth Potential | Limited (peak oil demand) | Strong (10–15% CAGR) |

| Policy Risk | Carbon taxes, bans | Subsidy dependence |

| Long-Term Outlook | Decline beyond 2035 | Expansion beyond 2050 |

Investors think oil & gas is “dying.” In reality, short-term fossil plays may outperform green stocks in high-demand cycles. Balance matters.

Behavioral & Psychological Angle

- FOMO (Fear of Missing Out): Many chase “green IPOs” without fundamentals.

- Herd Bias: Investors pile into hyped stocks (e.g., Adani Green rally) without research.

- Greenwashing Trap: Funds label themselves “sustainable” but include fossil-heavy portfolios.

- Overconfidence: Believing renewables = guaranteed growth, ignoring risks.

Always test whether the company has real revenues or just policy dependency.

Future Outlook: 2030–2040

- Hydrogen Becomes Mainstream: By 2035, hydrogen expected in steel, cement, aviation.

- Battery Tech Evolves: Solid-state batteries may replace lithium-ion.

- AI-Energy Nexus: Tech giants (Google, Amazon) will become energy producers.

- India’s Rise: By 2035, India aims to be top 3 green hydrogen producers globally.

“Global Green Investment Roadmap 2025–2040” timeline chart.

A Simple Framework for Green Investing

3P Framework:

- Policy Alignment – Does the stock benefit from government policies?

- Profitability Path – Is there revenue visibility?

- Portfolio Diversification – Does it reduce concentration risk?

Numbered Lessons for Investors

- Green is mainstream, not niche.

- Policy support = lifeline but also risk.

- Diversification is essential (solar + hydrogen + storage).

- Watch India + China as demand hubs.

- Impact > ESG scores — measure real emissions avoided.

How-To Guide: Building a Green Portfolio

Step 1: Define focus (growth vs income vs balanced).

Step 2: Choose allocation (40% global ETFs, 40% Indian leaders, 20% innovators).

Step 3: Mix subsectors (solar, wind, storage, hydrogen).

Step 4: Use ETFs like ICLN (global) or Indian mutual funds for beginners.

Step 5: Monitor quarterly earnings + policy updates.

Step 6: Exit hype stocks if fundamentals weaken.

Note: Educational only, not investment advice.

Investor Insight

“Back in 2018, I met an investor in Mumbai who had built his portfolio around traditional oil & gas companies. He admitted that while the dividends were strong, the stock prices hardly moved. In 2021, he shifted just 20% of his portfolio into Green Energy Stocks — solar, wind, and battery tech companies. By 2024, that small slice had outperformed his entire fossil fuel portfolio. His takeaway? ‘The world is moving, and I don’t want to be left holding yesterday’s energy.’”

Lesson: In green investing, timing + patience matter. Don’t blindly avoid fallen players — some reinvent better than new startups.

Key Takeaways

- Green Energy Stocks beyond 2025 = mainstream growth engines.

- Global + Indian alignment offers unique diversification.

- Behavioral traps (FOMO, herd, greenwashing) must be avoided.

- A simple framework (Policy, Profitability, Portfolio) helps guide decisions.

- 2030–2040 = Hydrogen, AI, and India’s dominance.

The Road Ahead

Start Your Journey:

- Explore green ETFs for safer entry.

- Track Indian disruptors like Adani Green, Suzlon, Waaree.

- Stay informed on global climate IPOs.

Will you be an observer of the green revolution — or an active participant shaping the world’s energy future?

Explore More

- AI in Stock Trading 2025–26: Powerful Insights Separating Hype from Reality

- AI-Powered Threat Intelligence: The Ultimate Double-Edged Sword in Cybersecurity

- 5 Ways Zero Trust Stops Hackers Cold

- Wealth Habits That Last: 10 Smart Money Systems for Life

- The Hidden Power of Compounding: 7 Proven Lessons for a Better Life

- What Is Green Power?

FAQs

- What are Green Energy Stocks?

Shares of companies focused on renewable energy or climate tech. - Are green stocks risky?

Yes, due to policy reliance, but they also have strong long-term growth potential. - Which are top Indian Green Energy Stocks?

Adani Green, Suzlon, Waaree Renewables, KPI Green, NTPC Green. - Which are top global Green Energy Stocks?

NextEra, Orsted, Brookfield Renewable, Plug Power, CATL. - What’s the difference between ESG and Impact investing?

ESG scores companies; Impact measures real-world emissions avoided. - How do I start small in green investing?

Use ETFs or mutual funds like ICLN, TAN, or Indian renewable funds. - What is green hydrogen’s future?

High potential, especially in industrial decarbonization by 2030+. - Why is India critical in Green Energy Stocks?

Massive demand + government targets + cost competitiveness. - How to avoid greenwashing?

Check company’s revenue mix — is it really green or just labeled so? - Are dividends available in Green Energy Stocks?

Utilities like Brookfield and NextEra provide steady dividends.